The specialist contractor saw revenue dip slightly by 2% to £1.4bn, but profits surged thanks to strong performance across UK and Irish operations and solid returns from its US energy investment.

Operating profit also rose 11% to £80m, while net cash climbed 15% to £400.5m, bolstering Murphy’s ability to invest in green tech, talent and overseas expansion.

The improvement saw the group-wide operating margin reach 6%.

In a strong year of work winning, Murphy’s order book jumped 64%, reaching a record £5.4bn across the UK, Ireland, and North America by the end of 2024.

| Murphy Group financial highlights | |

|---|---|

| Pre-tax Profit | £84m (↑25%) |

| Operating Profit | £79.6m (↑11%) |

| Revenue | £1.4bn (↓2%) |

| Net Cash | £400.5m (↑15%) |

| Order Book | £5.4bn (record) |

| Headcount | 4,060 (↑5%) |

Chief executive John Murphy said: “Throughout 2024, we successfully navigated economic pressures, changes in government policy and inflationary pressures, demonstrating the group’s resilience.

“The sector’s significant investments in transportation, water and energy infrastructure, underpins our confidence in the future with Murphy well-positioned to capitalise on the opportunities these investments bring.

“We’ve delivered another strong year of growth, while navigating inflation and policy shifts. With a record £5.4bn order book and growing global presence, we’re confident about the future.”

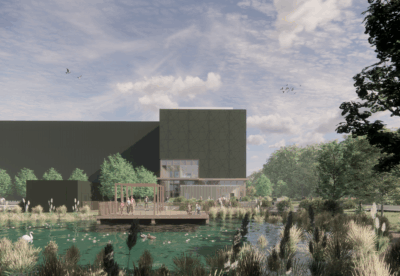

The group delivered major projects including stations at Beaulieu and Cambridge for Network Rail, tunnelling on London Power Tunnels 2, and upgrade works for National Grid.

It also entered the Australian market last month, taking a 40% stake in Sydney-based civils outfit Abergeldie.

Murphy now employs 4,060 staff globally, up 5% on the year.

May 2025.gif)

.gif)